Advantages Of Investing In Performing Notes Or Partials

“I’ve been a landlord for over 20 years, and I would rather receive a mortgage payment than a rent check any day.” “That means I do not have to deal with maintenance, tenants, liability, contractors, townships etc.”

Investing in real estate mortgage notes is a little-known investment opportunity to most investors.

Real estate notes are not correlated with stocks and bonds and are therefore not affected by the performance of these two types of investments. Real estate notes produce income/returns from the underlying mortgage payments. The investor may also benefit from the “collateral gap” between the amount paid to purchase the note and its value when the note is paid off, refinanced, or if the home is sold. The real estate notes are usually purchased from lenders at a discount.

Before we go any further, we need to address this basic question, “What is a note?”

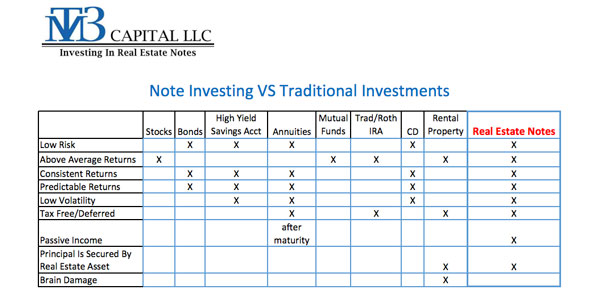

Let’s Look At How Owning Notes Compare To Other Investments

- From a tax perspective there are no depreciation advantages with notes. As far as appreciation, the face value of the note is the face value of the note.

- But there are times when the note is purchased at a discount and there can be a “phantom appreciation” because note values are directly related to property values.

- An added plus with investing in a note is that you don’t need any credit or have to qualify like you would when you purchase a property.

Many investors new to investing in notes are afraid of the foreclosure word. If you have a rental property and the tenant doesn’t pay the rent, you will have to take them to court by filing an eviction. Several things can happen when a tenant doesn’t pay the rent:

- You must file for an eviction

- You lose the rent owed

- You must pay court costs

- You must fix the property to be able to re-rent the unit

- You have a vacancy

Most of this happens without recourse since most tenants do not have the assets.

When you own the real estate note you are dealing with the homeowner. So, if the homeowner misses any payments those money’s can be collected just like the bank does. Some of these fees could be:

- Collection of missed payments

- Late fees

- Any attorney fees

- Corporate advances

If the property has equity in it any of the fees can be attached to the loan balance, per your loan documents, and you will be able to recover them as long as there is enough equity.

Also, homeowners have a significantly different mindset then tenants. A homeowner usually has more invested into the property like “sweat equity” and “pride of ownership”.

Principal Is Secured By Real Estate Asset

With a real estate note and mortgage, you have a secured first lien on the property. Your principal risk is relatively low, especially when you have equity in the mortgage. “It’s better to have a bad loan with equity, than a bad tenant”. Real estate notes with 25% – 40% equity in them are a low risk and highly collateralized investment.

Notes Profits Compared To Rental Property

Performing Real estate notes usually produce similar returns to hard Real Estate Investing after factoring in maintenance and management fees.

Performing Real estate notes usually produce similar returns to hard Real Estate Investing after factoring in maintenance and management fees.

A performing note is one where the homeowner is current on their mortgage payments. A non-performing note is one where the homeowner is not current on their mortgage payments. A non-performing note can at times produce returns that exceed today’s Private Money mortgage yields that can range from 8%-16% plus discount points. A non-performing note can be rehabbed just like a piece of real estate. You can make more money when you rehab the note (just like rehabbing the property).

Remember notes are purchased at a discount. For this reason, there is a high probability of producing higher returns with notes. When you purchase a note at a discount you make your money when you buy it. You do not usually make money off the borrower’s equity.

Keeping Up With Notes vs Rentals

Notes are much easier to manage than is rental property.

Notes are much easier to manage than is rental property.- Notes are also a much more passive investment than is rental property. Actually, notes can turn tenants, toilets, and clogged drains into what is called mailbox money. When you own a home, you do not call the bank to come fix any maintenance problems.

- When owning rentals, the location of the property can determine if you want to buy it or not. It is easier to own notes in areas that you might not want to buy and hold real estate, especially for the short term.

- Notes are often less liability and responsibility than owning rentals.

- Notes also avoid dealing with vacancies, tenants, maintenance, and contractors.

Managing A Note vs Rental Property

Typically, a note buyer can manage more notes than they can properties. A loan counselor can manage 18-24 loans per month. Do you think a real estate investor can handle 18-24 properties per month? Not likely.

A loan servicer is more affordable than a real estate property manager. Property managers can charge anywhere from 8-10% of the gross rents and often charge one month’s rent to find a new tenant. Loan servicers have a onetime setup fee of around $25-$175 and monthly fees that range from $18-$50 per month. A performing note can have a similar monthly cash flow as a typical rental property.

Anything You Can Do With A House, You Can Do With A Note

- You can flip or wholesale a note

- You can refinance the borrower.

- You can rehab a note. Turn a non-performing note into a performing note.

- You can sell the full note, or you can recoup your original investment by selling a partial.

- You can invest in notes inside of your IRA or retirement accounts to increase your retirement accounts.

- You can borrow against a note since it is a real asset. Also known as a Collateral Assignment or Hypothecation

- You can borrow against the equity in a property and invest it in a note to increase your return from that same property.

- Increase your cash flow from equity in real estate

- Better financing and leverage when buying real estate through the use of notes and seller financing. You can get a higher return on a rental property if the seller assists the buyer with financing.

Advantage Of Buying A Partial

From an investor’s standpoint investing in a “partial” is one of the lowest risk, highest return ways to invest your money. When someone selling a note sells the investor the complete remaining payments that is considered a full purchase. But when the seller only sells the investor a portion of the remining payments it is considered a partial purchase. It is in effect a 1st on a 1st. Let us say the note for sale has 20 years remaining. The seller can sell any portion of that note to an investor. They can sell 5, 8, 10 or even 12 years to an investor. Or how many years the investor is wanting to invest their money. The years sold will be the first portion of years on the note. If the investor wanted to invest their money for 8 years, then the seller would sell the first 8 years of the note to the investor. So, for the first 8 years the investor would collect the monthly note from the homeowner. The seller still owns the back 12 years. At the end of 8 years the seller will begin to collect the remaining 12 years of the monthly note from the homeowner.

The “Big Advantage” of investing in a partial is that the seller does not get paid until after the investor receives all of their payments. “That is right the investor is not in the investment by themselves.” “The seller is in it with them on the backend.”

Three Ways To Participate Or Invest In Real Estate Notes

- You can buy all the remaining payments of a note. This is considered a full purchase.

- You can buy a portion of the remaining payments. This is considered a “partial” purchase. (Explained above)

- You can borrow against a note since it is an asset. This is known as a Collateral Assignment or Hypothecation. An investor can make a loan to TM3 Capital LLC and we will in turn invest the money in notes and the notes will be put up as collateral. Again, an extremely very low risk investment with above average returns.

Note: It is suggested that notes be purchased inside of an entity like a LLC or Corp. Or with a retirement account like a Self Directed IRA or Self Directed Roth IRA, Education Account etc.